- Article

- Optimising Sales

- Seeking New Opportunities

How to power up your company's mobile strategy

It is the iconic image of the new smartphone economy taking shape in South-East Asia: a uniformed motorcycle rider checking their smartphone for another order.

South-East Asia is a young and digitally connected market. About 60% of the region’s population is under 35 and—by spending more time online than any other group of consumers anywhere in the world—this demographic drives a fast-emerging economy where the mobile phone is becoming the shop window, the payment mechanism and the delivery system.

Companies have a big opportunity to grow across the Association of South-East Asian Nations (ASEAN) region by enhancing their mobile-based sales channels. Sellers can directly connect with their consumers, better influence their buying habits, and then run more efficient supply chains.

The competing ride-hailing companies, Singapore’s Grab and Indonesia’s Go-Jek, are the exemplars of this new business world. They operate regionally, but use localised business models: converting traditional delivery mechanisms to app-based delivery channels and then expanding into other business sectors, especially e-payments.

Cash payments still dominate

The arrival of cheap smartphones over the past few years has resulted in an estimated 90% of internet access in ASEAN occurring on mobile phones. But despite rapid take up of mobiles and world-beating levels of online engagement, South-East Asian consumers still mostly favour making a purchase in cash, after first searching for products online. Social media uptake is also happening faster and more intensely than actual mobile-based shopping. Businesses need to appreciate that for some emerging ASEAN consumers, Facebook is the internet. For example, there were 130 million active Facebook users in Indonesia in 2018, just under half the population. These social-first behaviours make online marketing from a website outmoded.

HSBC’s Asia Head of Innovation – Global Liquidity & Cash Management, Jennifer Doherty says cash on delivery continues to be the preferred payment mechanism in ASEAN. This, she argues, reflects both the long-established habit of paying by cash when you receive your order, and the sheer proliferation of e-payments options, which can be confusing. Compared to more developed markets, ASEAN’s consumers tended to have less confidence in the “last mile” of delivery channels, an area that simply wasn’t a priority for the region’s suppliers. But, Doherty says local companies are now being forced to pay more attention to this part of the supply chain in order to remain competitive with overseas logistics companies, which can sometimes deliver in less than 48 hours. Some e-payments providers in ASEAN now offer escrow systems that withhold payments transfers until the consumer is happy.

With hundreds of e-payments wallets now available across the region, Doherty predicts that there will need to be some consolidation before usage really takes off. “Ease of use in the e-wallet system isn’t there because there are too many of them and they are all closed loops.” She says e-wallets need to evolve so that users can move money between different providers, just as they can between different bank accounts.

The “last mile” is the last frontier

E-commerce, argues Doherty, will grow fastest in those ASEAN countries that can address the last-mile logistics challenge and shift more of their customs rules and taxes into a digitised form to make them easier to navigate.

Doherty believes retailers trying to navigate through the proliferation of payments channels, from cash to bank debits, credit cards to e-wallets, face a challenge handling all these systems in a way that doesn’t turn customers off at the checkout. She says traditional banks can handle this seamlessly in the background and then provide retailers with the data they need to streamline their offerings.

Retailers just need the data and the insights that come with that and, if as a bank, you can give that to them regardless of the way the customer pays, then that adds benefit to their business. They can now start to think about how efficiently they can receive funds, which can be outside of a retailer’s control.”

|

With ASEAN customers spending so much time with social media, businesses face a challenge embedding their sales, payments and delivery channels inside social media platforms instead of using in-house internet sales channels. While there is a noticeable shift to selling new products on social, such as selling insurance to younger consumers via Facebook, Doherty says businesses still shouldn’t ignore older consumers who can be accessed via traditional online media.

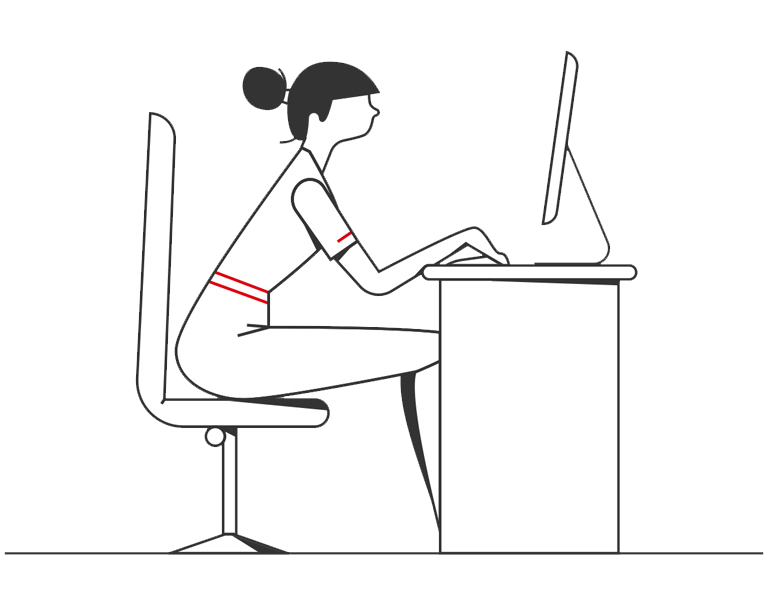

Shop digital but buy physical

Businesses also need to be prepared to operate in a constantly changing omni-channel world with mobile shopping but often physical purchasing. There have been some cases in South-East Asia of previously online-only retailers opening physical stores to broaden their marketing and cater to consumers’ desire to purchase goods in person.

“Generally we are seeing that high-value goods still drive the demand of a physical store, even if browsing and research are being done online,” Doherty says.

At HSBC, we have over 130 years of experience connecting businesses to ASEAN. With award winning trade and treasury solutions and more than 200 locations across ASEAN including Singapore, Malaysia, Indonesia, Thailand, Vietnam and the Philippines let us connect you.

Issued by HSBC Holding plc